I heard a speaker say recently that when people seek counseling for major problems in their lives, the problems almost always revolve around s*x or money. I've also been told that money problems are at the root of most marital fights and divorces. So why aren't we teaching our teenagers more about money before they get out on their own? Matthew 10:16 tells us to "be as shrewd as snakes and as innocent as doves" when dealing with the world. In the Parable of the Shrewd Manager in Luke 16, Jesus tells us that one of the things in which He wants us to be shrewd, or wise, is in matters of money. Not that He wanted His disciples to be dishonest like the manager in the story was, but that He wanted them to learn to use worldly things for eternal purposes in a wise way.

Too many people learn their money lessons the hard way, once they are deep in debt and have to climb their way out. I would like to teach my kids to be smart with money from the time they start earning it. One tool I have used, as a part of the Schoolhouse Review Team, is

WealthQuest for Teens. We reviewed a website subscription package that included a video, a workbook for the teen, a parent book, and a link to an online money management program.

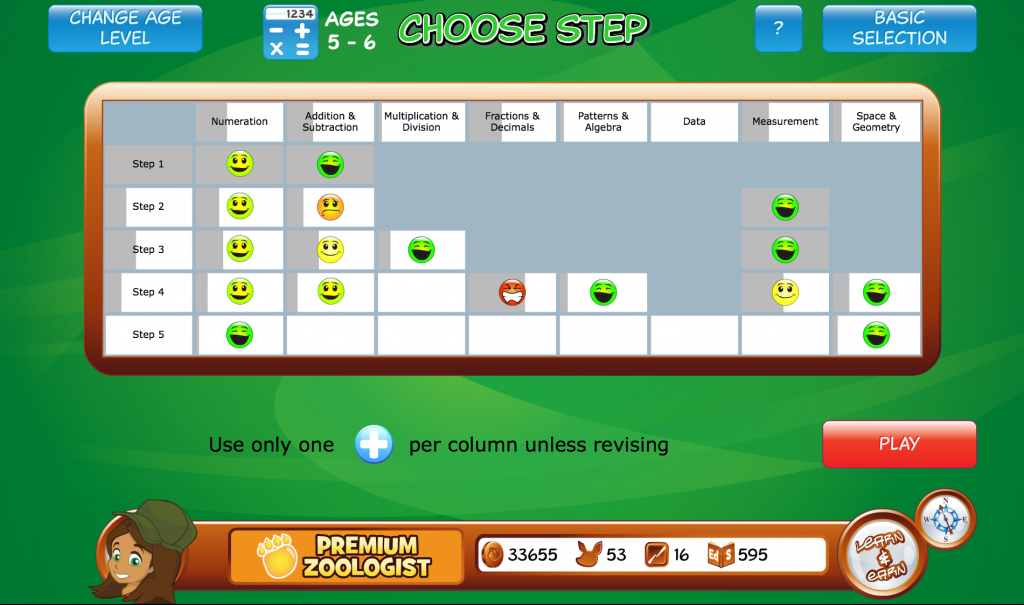

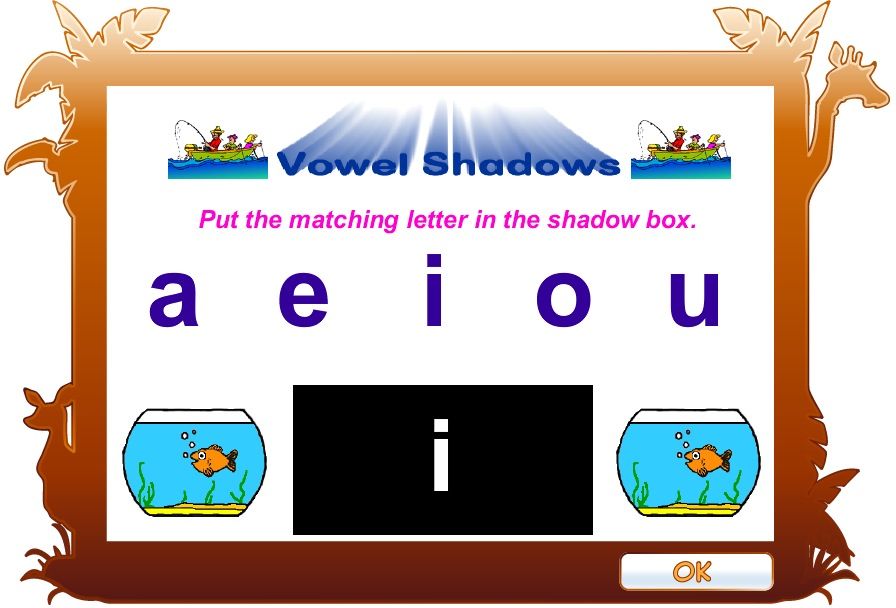

I have mixed feelings about this review. First of all, I really like the way the components were laid out. The online video itself includes the video teaching and examples (on the left of the screen below), and an interactive notebook (on the right of the screen). I haven't seen this with any other programs, and I really liked it. My son watched the videos, paused them when prompted to do so, filled in the information in the interactive notebook, and resumed the video. This is a great way to study and learn! A few times he got a little lost, and there was no way to rewind, but the video segments were not terribly long so we just started the segment over again.

There is an option to print the interactive notebook:

In addition, there is an eBook: the Basic Seminar QuickStart Guide, which is used for implementing the program after watching the videos. The purpose of the WealthQuest for Teens program is to have teens actually change their habits during the course, not to just read about good money habits. With that purpose in mind, the QuickStart eBook guided us through setting up the money tracking system and setting goals for what my teen wants to accomplish with his money. It has 30 short daily assignments, so that within a month, the teen is all set up and using the new system. All of this worked together very well. The eBook is a great reinforcer and implementation tool for what the student has just learned through the videos.

I also received the Parent Guide in eBook form. It had great information in it not only on how the program works for teens, but also about common mistakes parents make in teaching about money, better ways to handle the topic, and how to handle allowance and jobs at home, which is a question many homeschooling parents have asked me!

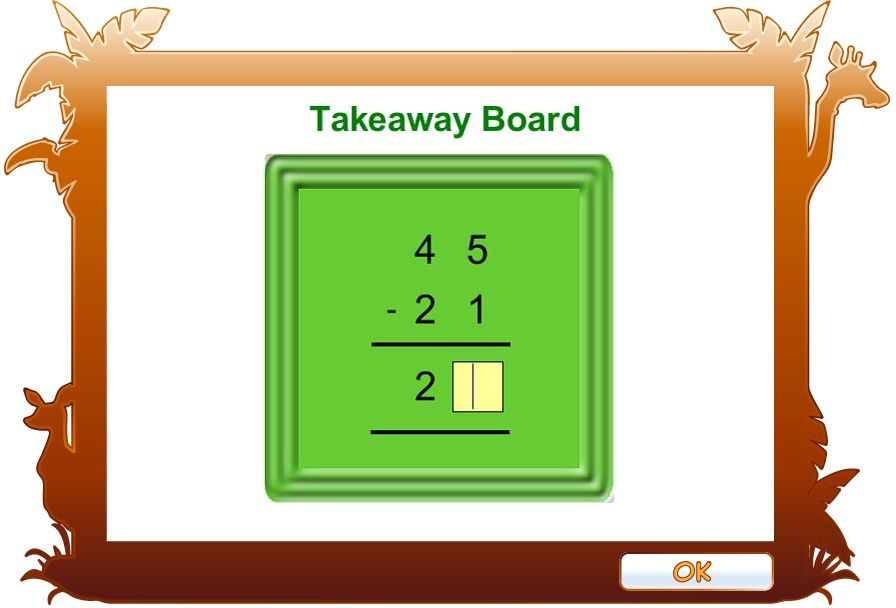

Here is a picture of a girl using the "Silo System" that is laid out in

WealthQuest for Teens. We are using envelopes rather than larger containers like this. The system is completely adaptable to what works best for you.

Finally, we were given a link to Money Trail, an online tool specifically for managing kids' money. We set up a child account and a parent account, so that my son can manage his money and I can track what he is doing through my account. Money Trail does not actually hold any of your money; it is simply a tracking tool. It is set up to deposit my son's allowance amount each Friday into his virtual account in the "Bank of My Parents," and we have it specifically set up to automatically divide the money he receives each week into "spend," "share," and "save" accounts. He can then track money he receives and money he spends to see where it is going over time. Money Trail also has a mobile version, so he can use it on his iPod Touch.

I agree with the author of the WealthQuest program, Jill Suskind, that it is very important to teach our teens about how to manage money. I like her approach, teaching that your financial success is more dependent upon your beliefs, attitudes, and habits about money than on the actual size of your salary. The program is not a "health-and-wealth-gospel" program or a "get-rich-quick" idea. Rather, it teaches the importance of managing the money that you have well, no matter how much it is. I like the inclusion of the "QuickStart Guide" and the Money Trail site, so that by the time the student completes the program, he is already implementing the system and managing whatever money he has.

The reason I have mixed feelings about this program is that in listening to the videos, even though the goal is to manage whatever money you have rather than to just "get rich," I still feel that the overall message of the program is that financial success is paramount. The students are told that they need to regularly read books about financial success and spend a great deal of time thinking about money. This can be taken several ways. Obviously, the program is about money, so perhaps all this has a place. People whose goal is service over "getting rich," such as missionaries, perhaps need the most training in managing money. This program offers excellent tools and habits, including habits of giving to worthwhile causes and "making a difference." Still, though, the more I listened to it, the more I was concerned that it would influence my children to think that money is the most important priority in our lives - or that the freedom provided by having money is. It just isn't quite the worldview that I want to be coming from when I teach my children about money. I am always concerned that my kids may be too easily influenced by things like that. Then again, I probably don't need to worry too much about my teen being wrongly influenced, because when I asked my son what he thought of the program, he said basically the same thing that I just did!

The bottom line is that the

WealthQuest for Teens program teaches great habits about money, and while you may need to make sure you emphasize your own worldview while teaching it, it is nonetheless a unique and valuable tool for teaching teens about how to manage money, which is an absolutely necessary pursuit in today's world.

Here are the basics:

Author Jill Suskind

Ages 14-19 - can be used with older students, worked fine with my 13-year-old

Price $39.95

Disclaimer: I received WealthQuest for Teens at no charge for the purpose of a fair review. No other compensation was given, and all opinions are my own.